franchise tax board phone number for llc

Form 3522 is used to pay the 800 Annual Franchise Tax each year. Available 24 hours New York City Personal Income Tax and Sales Tax.

Franchise Tax Board Payments Arrcpa

The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee.

. Central Time shorter wait times normally occur from 8-10 am. Call 212-NEW-YORK or 212-639-9675 Out-of-City TTY 212-639-9675 Hearing Impaired Cash Bail. For California domestic stock corporations and California domestic limited liability companies visit FTBs webpage Guide to Dissolve Surrender or Cancel a California Business Entity FTB Publication 1038 or contact FTB directly at 916 845-7700 for more information.

By Name Exact search from beginning of name By Partial Name Any word combination in name Perform SearchClear Contents. A typed drawn or uploaded signature. 800-822-6268 Phone Hours of Availability.

Entity Status Letter requests made within this period will show the old entity name until FTBs records have been updated. Their hours are Monday through Friday from 8am to 5pm Pacific Time. For additional information see our Call Tips and Peak Schedule webpage.

Customer service phone numbers. Follow the step-by-step instructions below to design your franchise tax board fax number form. The California Franchise Tax Board is responsible for processing tax returns and issuing tax refunds in the state of California including non-residents who work in the state.

If the filing type is not available online or if you prefer to mail or deliver your filing click PDF to print a copy complete the form attach payment and mail or deliver to the Business and Commercial Services. California Franchise Tax Board Contact Info To contact the California Franchise Tax Board you can call 1-800-852-5711 or visit their website at httpwwwftbcagov. While hold times can sometimes be long the FTB has an option to hold your place in line and call you back.

Franchise Tax Board FTB Our mission is to help taxpayers file tax returns timely accurately and pay the correct amount to fund services important to Californians. This Google translation feature provided on the Franchise Tax Board FTB website is for general information only. Franchise Tax Board Exempt Organizations Unit MS F120 PO Box 1286 Rancho Cordova CA 95741-1286.

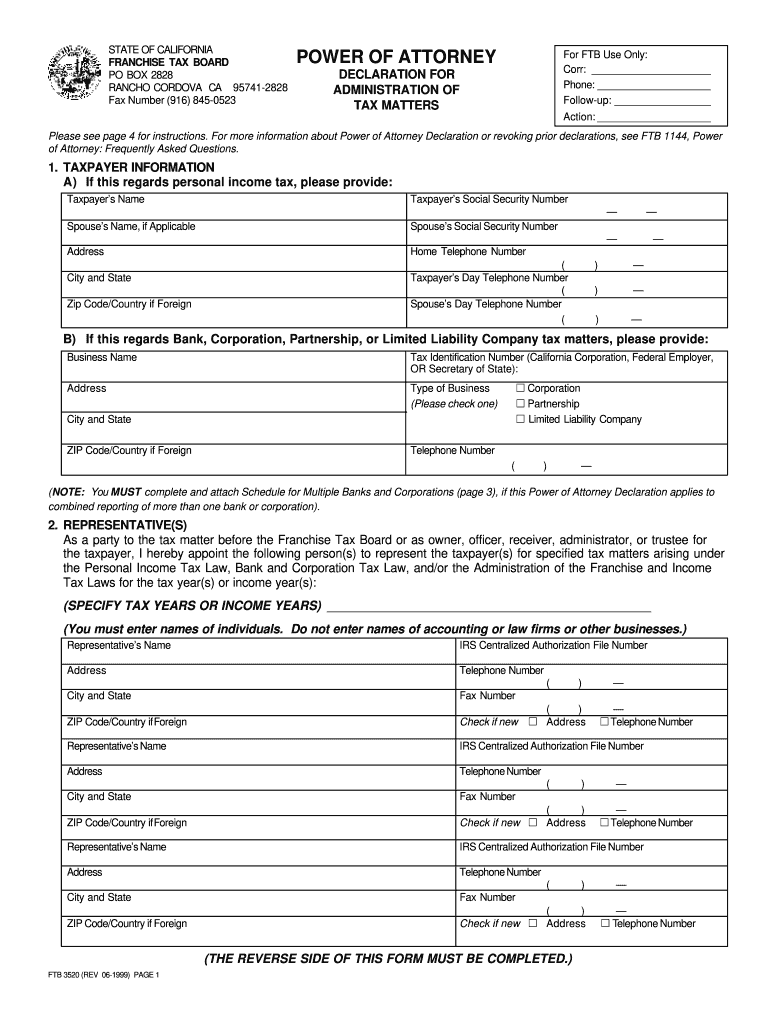

Please choose a name search method. Owner Member Power of Attorney Representative Business Representative AccountantCPA Other. Visit the FTB Forms page.

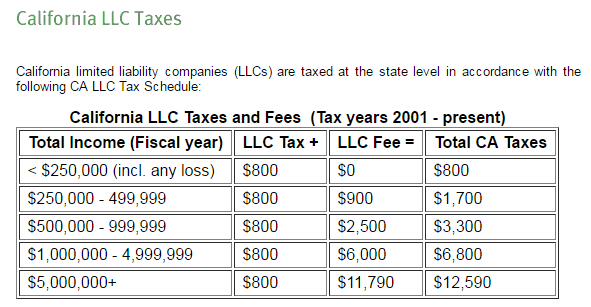

The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered through the. Choose to file online by clicking the ONLINE link and proceed to file electronically which is payable by credit card or ACH. And Franchise Tax Board.

And noon Between noon and 5 pm. This will get you to a person. Consult with a translator for official business.

California Franchise Tax Board Contact Info If you have any questions you can contact the California Franchise Tax Board FTB at 800-852-5711. Uniform Commercial Code 302 739-3073 option 4. General Information 302 739-3073 option 2.

Decide on what kind of signature to create. Call Back Request Time. 1 If you simply need to ask someone questions about your business dial this number.

Update regarding General Information. Service of Process 302 739-3073. Select the appropriate tax year.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web. Employment Development Department 3321 Power Inn Road Second Floor Sacramento CA 95826. Changes to Franchise Tax Nexus.

The excise tax is based on net earnings or income for the tax year. Create your signature and click Ok. Electronic Reporting and Webfile Technical Support.

Weekdays 7 AM to 5 PM. To search enter either an Entity ID or Entity Name. 800-852-5711 916-845-6500 and Address is 300 S Spring Street Suite 5704 Los Angeles CA 90013-1265 USA The California Franchise Tax Board is a public agency located in Los Angeles United State s.

916-845-7033 Corporations outside the US only 916-845-7166 Limited Liability Companies outside the US only 916-845-7165 Partnerships outside the US only Court-ordered debt COD Collections for California courts 916-845-4064 Open weekdays 8 AM to. All LLCs in California must file Form 3522 and pay the 800 Annual. The undersigned certify that as of July 1 2021 the internet website.

California Franchise Tax Board Contact Phone Number is. Type of Contact For Limited Liability Companies and Stock Corporations For Nonprofit Corporations. New York State Department of Taxation and Finance.

Please have your 11-digit taxpayer number ready when you call. Federal Income and Payroll Tax. Customer service phone numbers.

Franchise Tax Board Business Entity Correspondence PO Box 942857 Sacramento CA 94257-4040. State of California Franchise Tax Board Corporate Logo. Look for Form 3522 and click the download link.

There are three variants. Franchise Tax 302 739-3073 option 3. Select the document you want to sign and click Upload.

California Franchise Tax Board Certification date July 1 2021 Contact Accessible Technology Program. Annual Tax Every LLC that is doing business or organized in California must pay an annual tax of 800. After the voice gets past asking you if you would like the spanish version select option 2 then option 4.

Phone 510 622-4693 Office Address 1515 Clay Street Suite 305 Oakland CA 94612-1445 Sacramento Online Schedule an appointment Phone 916 227-6822 Office Address 3321 Power Inn Road Suite 250 Sacramento CA 95826-3893 San Diego Online Schedule an appointment Phone 619 688-2550 Office Address 7575 Metropolitan Drive Suite 201. Visit the IRS website or contact a local office in California. The Comptrollers office has amended Rule.

While we are available Monday through Friday 8 am-5 pm. The Division of Corporations will no longer provide entity filing history over the telephone. Select Limited Liability Companies.

Phone 916-657-5448 Mail California Secretary of State Document Filing Support PO Box 944228 Sacramento CA 94244-2280 Visit Limited Liability Company Filing Information FTB 3556 for more information.

Franchise Tax Board Fill Online Printable Fillable Blank Pdffiller

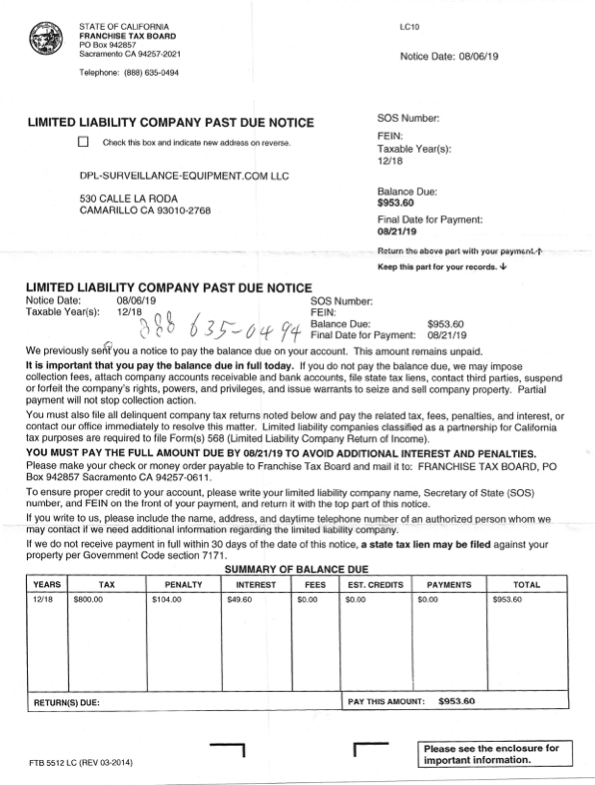

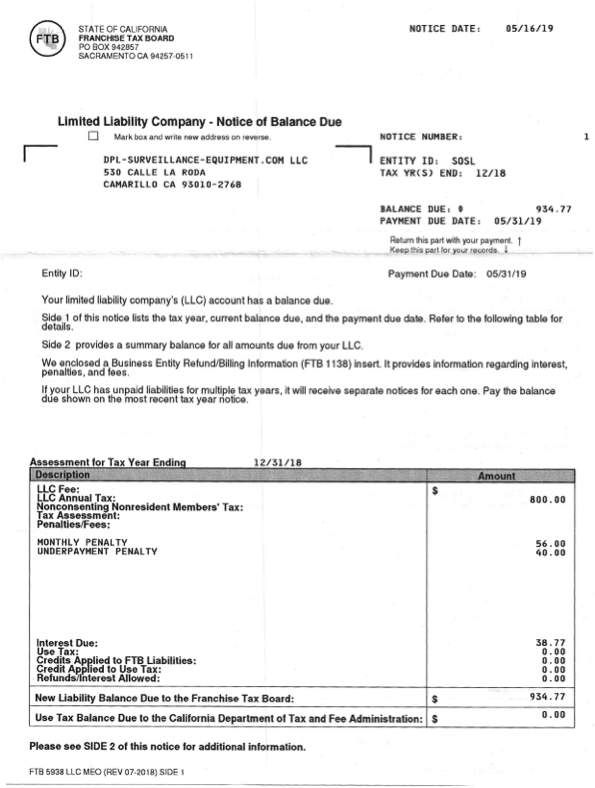

Even The State Franchise Tax Board Is Trying To Scam Me Dpl

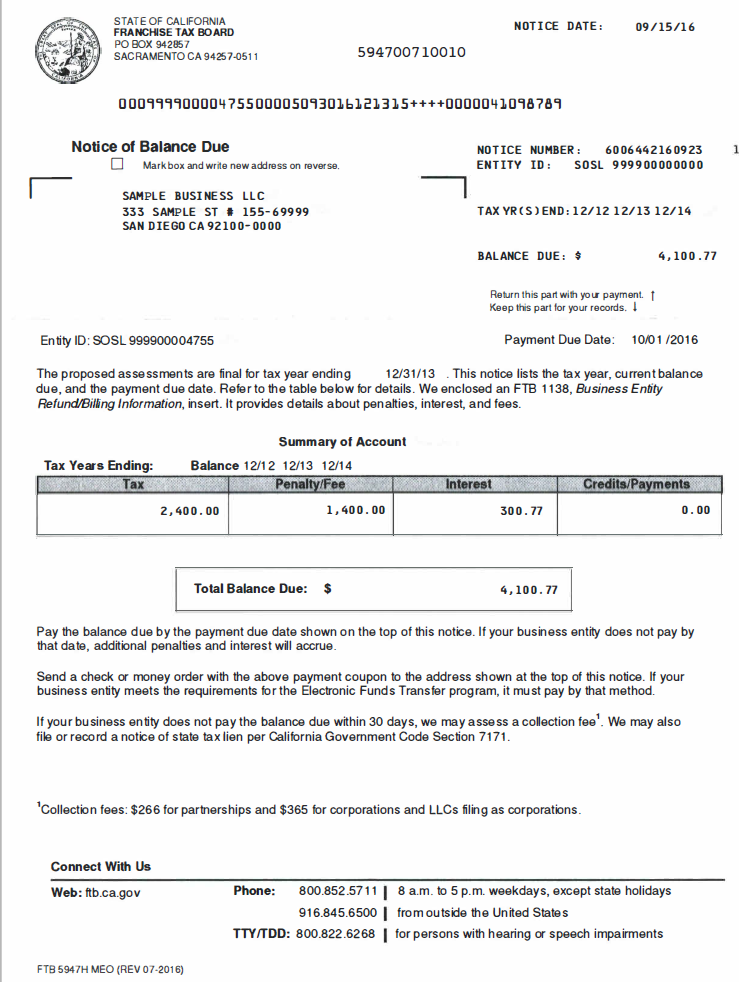

Ftb Notice Of Balance Due For Llcs Dimov Tax Cpa Services

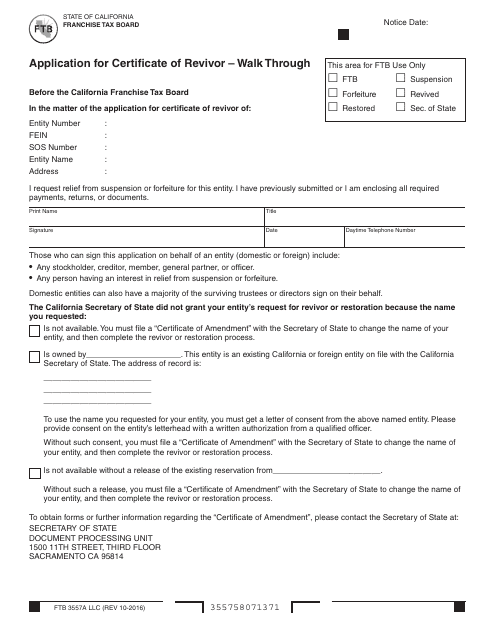

Form Ftb3557a Llc Download Fillable Pdf Or Fill Online Application For Certificate Of Revivor Walk Through California Templateroller

How To Speak With An Actual Representative At The Franchise Tax Board Of California Ca Ftb Quora

How To Speak With An Actual Representative At The Franchise Tax Board Of California Ca Ftb Quora

How To Pay Your California Llc 800 Annual Franchise Tax Online Without Franchise Tax Board Account Youtube

Franchise Tax Board Payments Arrcpa

Franchise Tax Board Ca Ftbfiling Sc Twitter

Franchise Tax Board We Can Help Consulta Gratis 888 468 0609 Servicio Al Cliente 888 959 0207

Ftb Notice Of Balance Due For Llcs Dimov Tax Cpa Services

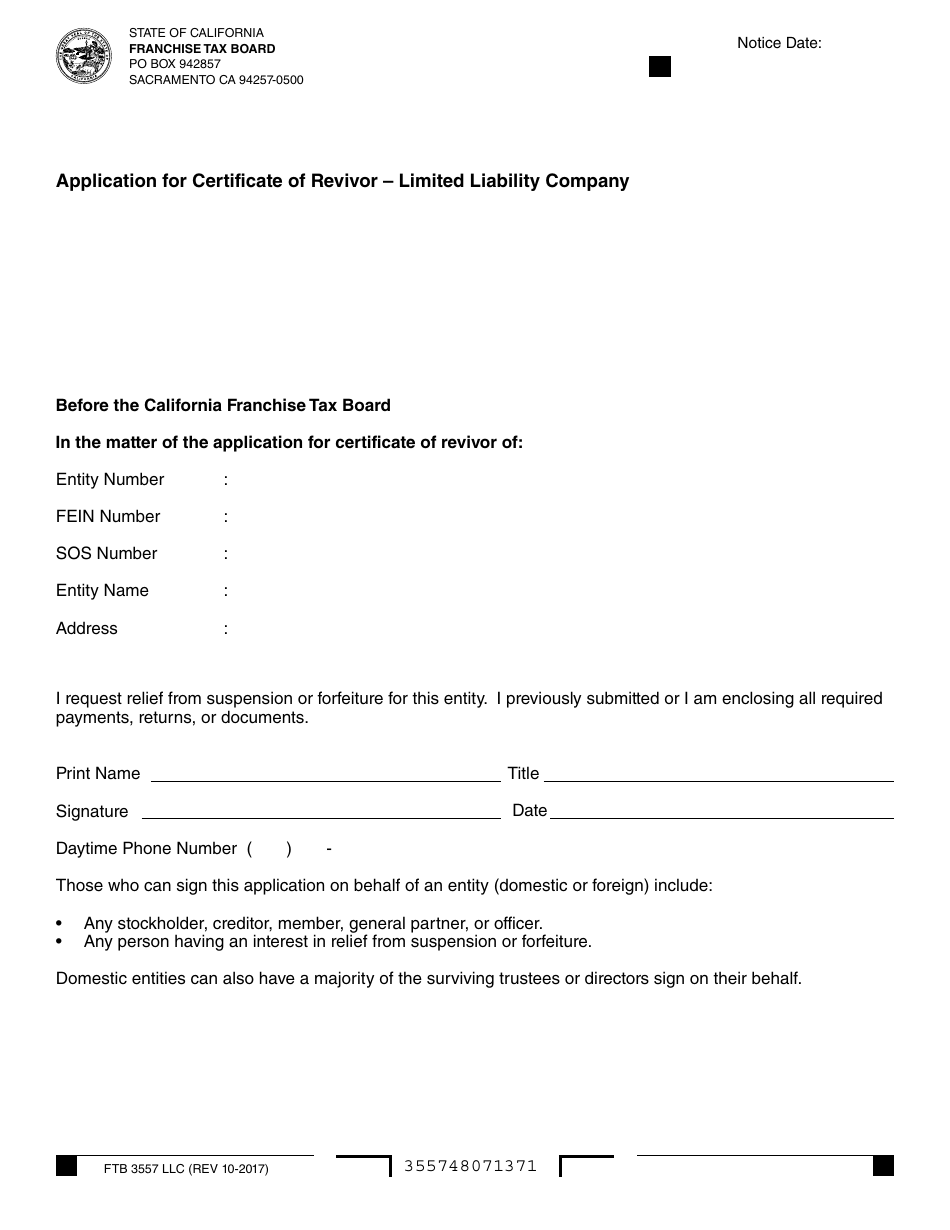

Form Ftb3557 Llc Download Fillable Pdf Or Fill Online Application For Certificate Of Revivor Limited Liability Company California Templateroller

Even The State Franchise Tax Board Is Trying To Scam Me Dpl

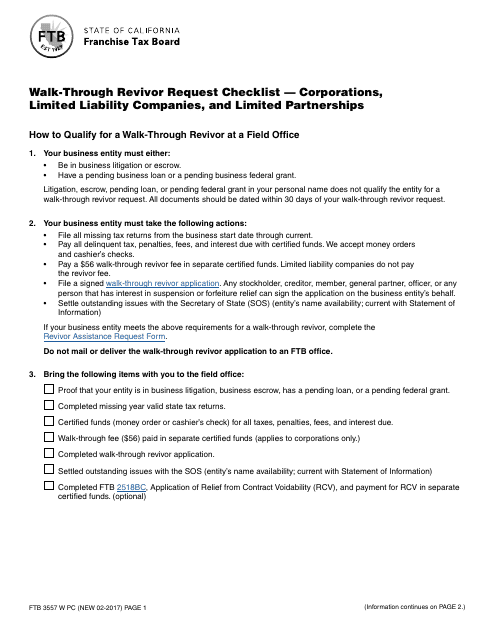

Form Ftb3557 W Pc Download Fillable Pdf Or Fill Online Walk Through Revivor Request Checklist Corporations Limited Liability Companies And Limited Partnerships California Templateroller