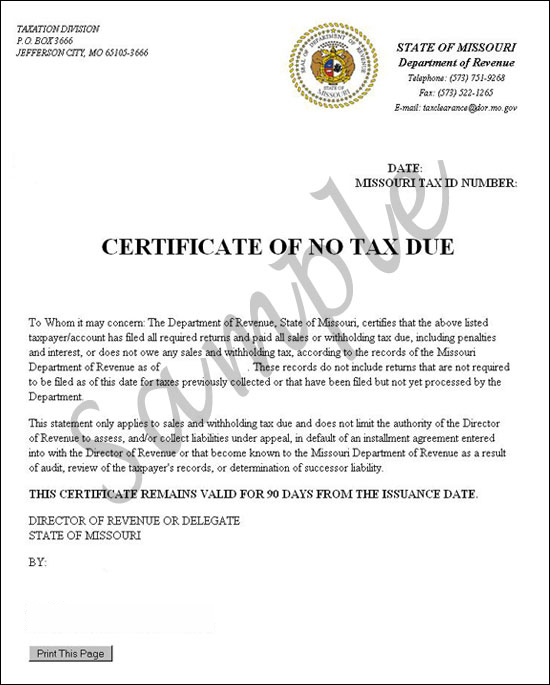

missouri vendor no tax due certificate

Jefferson City MO 65102. If you need a No Tax Due certificate for any other reason you can contact the Tax clearance Unit at 573-751-9268.

Asking For Social Security Numbers On Job Applications Goodhire

Missouri Department of Revenue Tax Clearance Unit at 573 751-9268.

. The SalesUse Refund and Exemption Section can be reached at 573-751-2836 or email protected if your company or organization has been awarded an exemption letter from the Department of Revenue. Submit with filing fee of 2500 and Certificate of Tax Clearance issued from the Missouri Department of Revenue The undersigned corporation for the purpose of withdrawing from the. I require a sales or use tax Certificate of No Tax Due for the following.

If you have questions concerning the tax clearance please contact the. PO Box 778 600 W. Notification from the Missouri Department of Revenue of the business entitys Missouri Employer Identification Number.

If not required to be submitted submit a statement of explanation. Withdrawal of Foreign Corporation. Current Vendor No Tax Due letter from the Missouri Department of Revenue.

Make sure both the FEIN and state EIN are included on the letter. You can request a Certificate of No Tax from the government website. Have a valid registration with the Missouri.

If you have questions concerning reinstatements please contact the. Current vendor no tax due letter from the missouri department of revenue. A business that makes NO retail sales is NOT required by Section 144083 RSMo to present a Certificate of No Tax Due in order to obtain or renew its license.

R Business License r Liquor License r Other if not listed _____ 4. 2 any other documentation required to cure the dissolution for example all past due annual reports must be included if the corporation was. If you have questions contact.

Missouri vendor no tax due certificate. If taxes are due depending on the payment history of the business a cashiers check or money order may be required for payment before a certificate of no tax due can be issued. The Missouri Department of Revenue will issue a Vendor No Tax Due when a business is properly registered and has all of its salesuse tax paid in full.

If there is an issue with the business account and a no tax due cannot be issued the system will present a message that the business must contact the Department of Revenue to obtain one. If a business license is not required submit a statement of explanation. I require a sales or use tax Certificate of No Tax Due for the following.

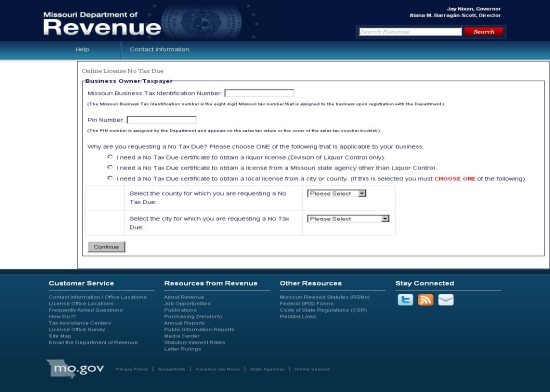

If you are requesting a No Tax Due use No Tax Due Request Form 5522. In order for the business owner or authorized representative to obtain a no tax due through the online system the business must. I am required to provide a No Tax Due Certificate for the following reason.

State law section 144083 RSMo requires businesses to demonstrate they are compliant with state sales and withholding tax laws before they can re. All groups and messages. Ashcroft Secretary of State.

Contact person Phone Number. No tax due please enter your moid and pin below in order to obtain a statement of no tax due. R Business License r Liquor License r Other if not listed 4.

A Certificate of No Tax Due is NOT sufficient. Once the form is completed and signed by a corporate officer. No tax due please enter your moid and pin below in order to obtain a statement of no tax due.

How Do I Get A No Tax Due Letter In Missouri. Missouri vendor no tax due certificate. A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and.

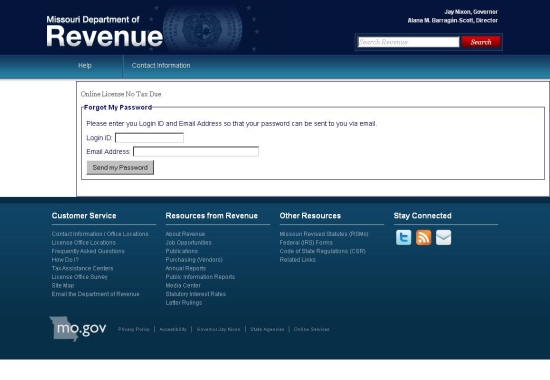

Application for Certificate of. Online No Tax Due System Information - Missouri Added 14 minutes ago Note. Please enter your MOID and PIN below in order to obtain a statement of No Tax Due.

Purchasing Vendors Annual Reports. I require a sales or use tax Vendor No Tax Due to obtain or renew a contract with the state of Missouri. A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or salestaxexemptionsdormogov to request a Certificate of No Tax Due.

A Certificate of No Tax Due is NOT sufficient. Current Vendor No Tax Due letter from the Missouri Department of Revenue. Missouri Certificate Of No Tax DueCopy of evv electronic visit verification or telephony contract.

To obtain or renew a contract with the state of missouri. Missouri Department of Revenue Taxation Division. I require a sales or use tax Vendor No Tax Due to obtain or renew a contract with the state of Missouri.

Information available at httpdormogovforms943pdf. How To Obtain A Certificate Of Vendor No Tax Due A Vendor No Tax Due certificate can be obtained from the Missouri Department of Revenue when a business pays all of its salesuse tax in full up to date does not have a sales tax delinquency or does not sell tangible personal property at retail in Missouri. Please click on the applicable box below to obtain a no tax due certificate or be directed to the mytax missouri government portal.

If the business is properly registered and does not owe any Missouri sales or withholding tax this site will allow you to print your own Certificate of No Tax Due which you can present to the local or state agency. No Tax Due Request. The fax number is 573 522-1265.

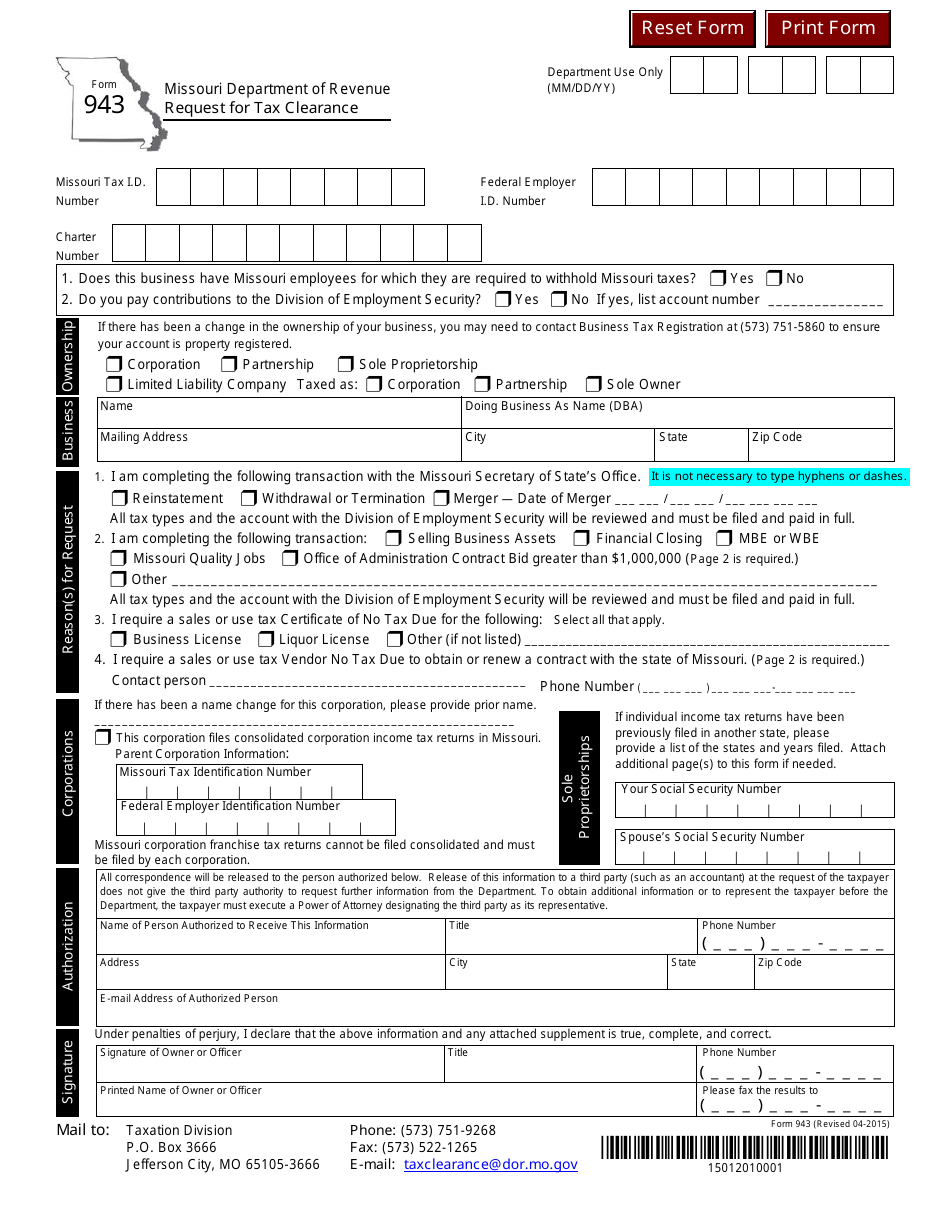

If you need a Full Tax Clearance please fill out a Request for Tax Clearance Form 943. Form 5522 Revised 12-2021 F. A Vendor No Tax Due can be obtained by contacting.

Select all that apply. Select all that apply.

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Information Form Template Unique Vendor Information Forms Sample Template Templates Form Vendor

Client List Spreadsheet Template For Apple Numbers Spreadsheet Template Free Spreadsheets Templates

Free Online Receipt Maker Fake Business License Fake Receipt Us Receipt Maker Receipt Letter Of Employment

How To Become A Notary Public Ehow Notary Public Notary Become A Notary

Missouri No Tax Due Statements Available Online

Get A Certificate Of No Tax Due For Next Hotel Purchase Texas Hotel Lodging Association

How To Register For A Sales Tax Permit In Missouri Taxvalet

Beginner S Guide To Dropshipping Sales Tax Blog Printful

Client List Spreadsheet Template For Apple Numbers Spreadsheet Template Free Spreadsheets Templates

Form 943 Download Fillable Pdf Or Fill Online Request For Tax Clearance Missouri Templateroller